Navigating Michigan’s Real Estate Licensing: From Classroom to Closing

Becoming a real estate agent in Michigan is an exciting journey that combines classroom learning with practical experience in the field. Whether you’re just starting out or looking to make a career change, understanding both the pre- and post-licensing requirements will help you launch and maintain

Building Your Future in Southeast Michigan: Why New Construction Might Be Your Best Move

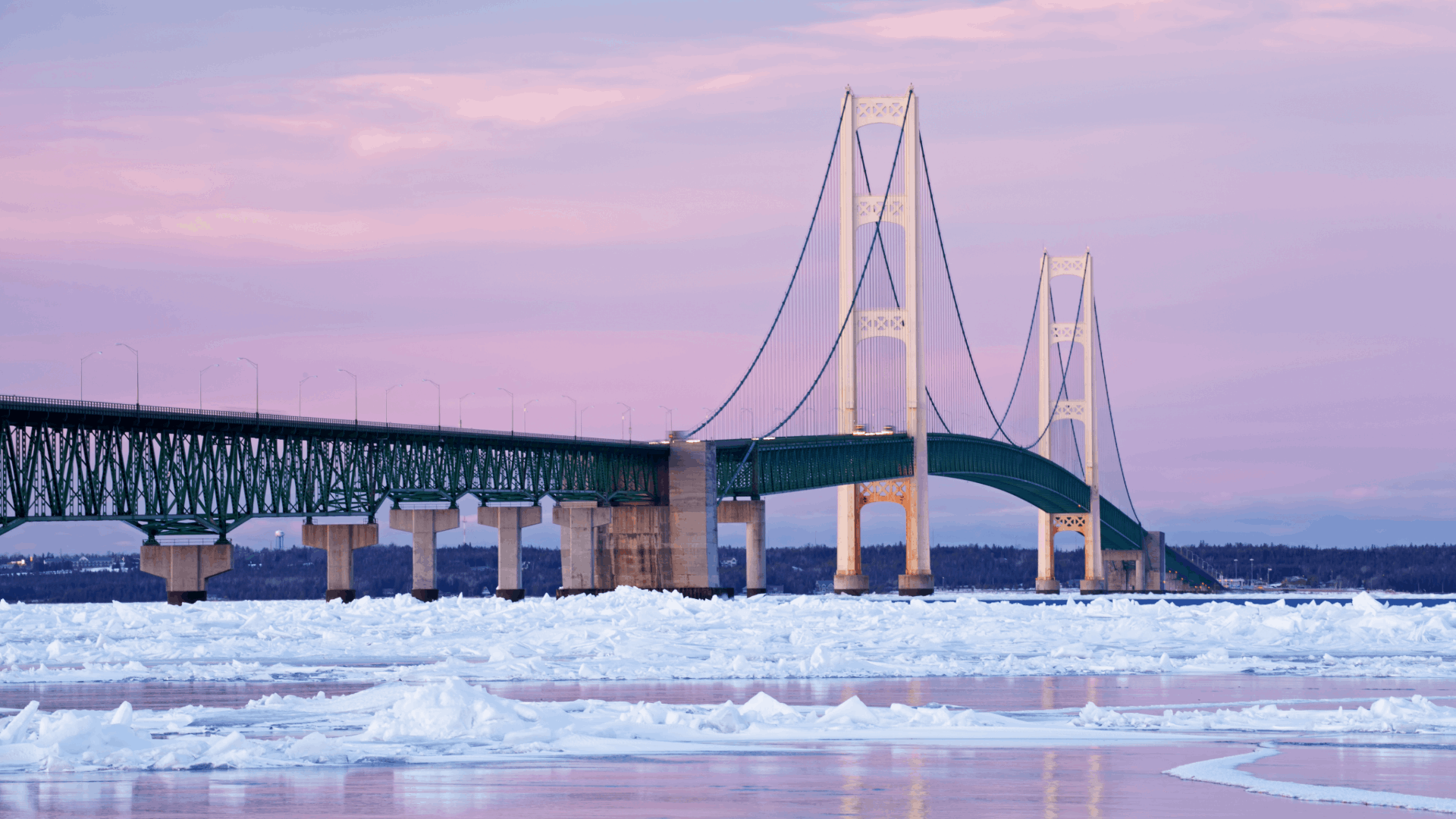

Southeast Michigan—from Toledo to Ann Arbor—is experiencing a wave of exciting new residential construction. This surge has caught the attention of both first-time buyers looking for modern amenities and seasoned homeowners who want to upgrade to cutting-edge designs. With stable demand in many comm

Your 2025 Home-Selling Roadmap

Selling a house is a big deal—whether it's your first time or you’re a seasoned homeowner looking to downsize or relocate. As a 40-something real estate agent with years of experience navigating the ups and downs of rural and suburban markets, I’m here to share some solid advice. If 2025 is your yea

Categories

Recent Posts